Hilton Honors points are regularly sold at a discount, but the way those promotions are presented differs from IHG.

Instead of explicit 100% bonuses, Hilton typically uses tiered structures, “up to” language, purchase thresholds, and account-level targeting. The result is less clarity about when discounted pricing is actually available.

What’s usually missing is any attempt to measure this pattern over time.

Not how Hilton describes its promotions, but something more practical:

If there isn’t a Hilton points sale today, how long would you realistically have to wait for one?

This piece answers that question using the same day-by-day approach as the companion IHG analysis, so the programs can be compared directly. Another companion Marriott analysis presents a minor variation on the same theme.

Scope and definitions

To keep the comparison clean, this analysis uses the same window and methodology as the IHG study.

Time window: 1 June 2024 to 31 January 2026 (610 days)

What counts: Hilton buy-points promotions where top-tier pricing reached ~0.5 cents per point

Tiered or “up to” bonuses: Counted if the highest tier achieved ~0.5 cpp

Lower tiers: Ignored

All dates inclusive

Hilton promotions are often tiered or targeted. For this analysis, a day is counted as a “sale day” if full-bonus pricing at roughly 0.5 cpp was available at the top tier, which is the economically relevant price for most buyers.

For each calendar day in the window, one question was asked:

If a Hilton points sale is not live today, how many days until the next one?

Sale live that day: zero

No sale: number of days until the next sale begins

This produces a complete daily time series of waiting time.

How often was a Hilton sale already live?

Across the period analysed, Hilton had a buy-points promotion pricing points at approximately 0.5 cpp live on 223 of 610 days (36.6%).

On those days, there was no timing decision to make.

That alone explains why Hilton points often feel readily available at discounted pricing, even though promotions are not continuously live.

The more useful question is what happens on the remaining days.

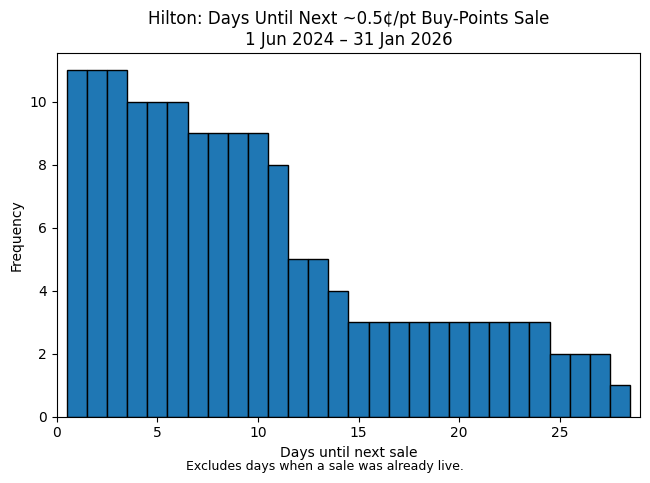

Conditional waiting time

How long you typically wait for the next Hilton sale

To answer that, all days where a sale was already live were removed.

This isolates the real decision problem:

If I check today and Hilton is not selling points cheaply right now, how long will I have to wait?

Excluding “zero” days:

Average wait: ~10 days

Median wait: ~9 days

75th percentile: ~14 days

90th percentile: ~21 days

Maximum observed wait: ~28 days

There were no extended dry spells in this window.

Results (Hilton, Jun 2024–Jan 2026)

Across all non-sale days:

Half the time, the next sale arrived under 10 days

Three quarters of the time, it arrived within ~14 days

Nine out of ten times, it arrived within ~three weeks

The longest gap observed was four weeks

Hilton sales are not continuous, but the waiting time between them is short and predictable.

How this compares to IHG

Both datasets use the same calendar window:

1 June 2024 to 31 January 2026 (610 days).

Over that period:

IHG: full 100% bonus live on 295 of 610 days (~48%)

Hilton: top-tier ~0.5 cpp live on 223 of 610 days (~37%)

At first glance, this suggests IHG discounts points more often. That is directionally true. But frequency of live sale days is only half the story.

The other half is how long you typically wait if no sale is live today.

Conditioning on non-sale days only:

IHG: median wait ~10 days; 90% of waits ~30 days or less

Hilton: median wait ~9–10 days; 90% of waits ~21 days or less

This is not a contradiction.

IHG tends to run fewer but longer promotions, often extended 100% bonus windows lasting weeks. Hilton runs more frequent but shorter promotions, usually tiered or capped, that restart regularly with slightly different terms.

The result:

IHG covers more total days with active sales

Hilton covers fewer total days, but the gap between sales is usually shorter

IHG feels “always on” because discounts remain visible for long stretches. Hilton feels less predictable because promotions are framed as temporary and conditional, even though the waiting time to the next sale is typically short.

The pricing is not meaningfully scarcer. It is structured and presented differently.

About Hilton’s “uncertainty” language

Hilton’s promotions often sound conditional:

“Up to 100% bonus”

Tiered bonuses

Account-level caps

This creates the impression that outcomes are unpredictable.

In practice, for buyers who wait and purchase at the top tier, the effective price repeatedly converges around ~0.5 cpp. The uncertainty is largely presentational rather than economic.

The data show that this pricing level appears frequently enough that waiting is usually rational.

What this implies for buying Hilton points

~0.5 cpp functions as Hilton’s market price

Sales recur often enough to anchor expectations.

Urgency is usually overstated

If no sale is live today, another is likely within weeks.

Points purchases remain just-in-time decisions

Frequent availability lowers timing risk, but does not justify speculative buying.

Decision rule (Hilton)

If a sale is live today:

Treat ~0.5 cpp as baseline pricing

Buy only with a defined redemption in mind

If no sale is live:

Median wait ~9 days

In 90% of cases, the wait is three weeks or less

Waiting longer than a month has been uncommon

Exception:

Ignore this rule only when award availability is genuinely scarce and the cash alternative is materially worse.

Why this analysis exists

Hilton points are often described as “frequently on sale,” but that description is too loose to guide an actual purchase decision.

Looking at the calendar day by day, rather than promotion by promotion, makes the timing risk explicit. Once you do that, much of the perceived uncertainty disappears.

The practical question is not whether a specific promotion advertises a good cents-per-point figure.

It is whether the program regularly returns to the same effective price.

In Hilton’s case, the data show that ~0.5 cpp functions as a recurring reference price. Sales are structured differently each time, but the outcome at the top tier converges to roughly the same level often enough that it sets expectations.

Once you view Hilton pricing through that lens, buying points becomes a question of when, not whether.

Data and sources

This analysis is built on historical Hilton Honors buy-points promotion dates compiled and reported over time by Frequent Miler and LoyaltyLobby.

All day-by-day conditioning, waiting-time calculations, and comparisons are original to this analysis and use the same methodology as the companion IHG study.